iFlash4U - Keywords & Concepts

[Identify] Product Category

Healthcare Types of Policies 16% (6.4-Hours)

The Pre-Licensing course outline requires us to discuss all the “Types of Policies” we’re authorized to sell once licensed. Our goal is to [Explain] course content utilizing United Healthcare illustrations and marketplace resources.

Policy Provisions, Clauses, and Riders 23% (9.2-Hours)

[Identify] Creative need – Vocabulary

The following is an excerpt from a basic United Recruiting flier. I’ve identified the language relevant to pre-licensing.

Copayments are the charge or set dollar amount that members are required to pay for certain services per their benefit plans. In addition to office visit copayments, members may also be responsible for copayments when they visit a facility or hospital.

Facility and hospital copayments are in addition to the calendar-year/policy-year deductible and coinsurance. Facility and hospital copayments do not apply to the deductible and continue to apply after the deductible is satisfied.

These copayments may be referred to in plan documents as “Per–Occurrence copayments” (OR) “per-occurrence deductibles.”

[Identify]

Assignment = Beneficiary Designation

[Identify] Major Medical has no Individual Underwriting

° [Identify] Comprehensive Reimbursement type policy which provides coverage for all 10 essential coverages.

[Compare] Copay (vs) Co-Insurance.

[Identify] In Pre-licensing, Copay = HMO (Managed Care)

[Define] cost sharing device associated with Major Medical.

[Identify] Initial Dollar Amount, The Policy Owner is Responsible for Paying.

– Associated with Major Medical

[Define] Percentage Participation, Risk Retention, cost sharing device.

[Identify], Co-Insurance is due once deductible has been satisfied.

[Define] Basic Medical Expense

[Identify] No deductible or Co-insurance.”

Individual Underwriting Required.

Policies have limitations

[Identify] Types of first dollar policies

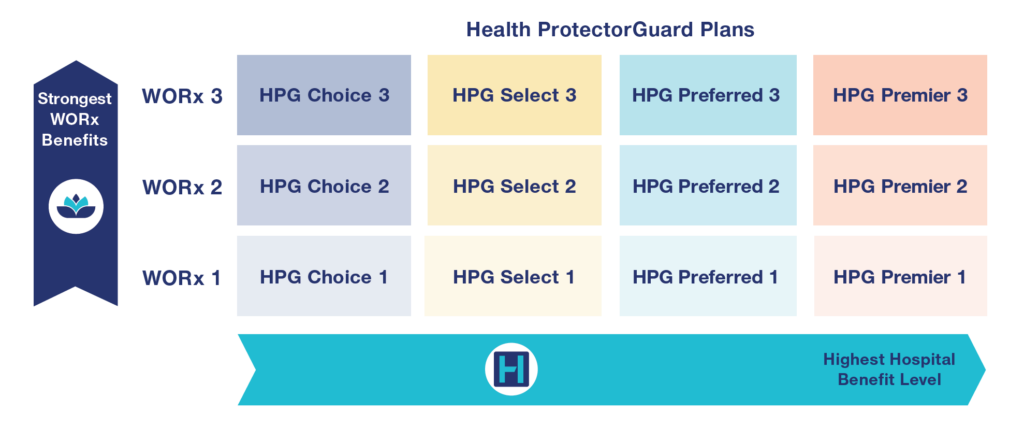

[Define] “MEMBERS of a certain Health Plan at a discounted rate”.

[Identify] Discounted Rate = PPO

[Compare] in network (vs) out of network

[Define] Indemnity = fixed amount.

First Dollar Policy

[ Explain ] No deductible or coinsurance because benefits are limited.

[ Identify ] Medicare takes over at age 65

[ Explain]

How are Indemnity Benefits paid to policy owners?

[Discuss] Assignment of Benefits to to healthcare provider.

[ Identify ] Fixed / Stated Benefit Amounts

[Explain] Policy owner, managed Healthcare – JLP Torn ACL Meniscus Story

Disclosure

[Identify] Must be provided at time of application

1. Buyers Guide = Generic information

2. Policy Summary = Specific information about the policy being applied for

3. Prospectus = Variable Contracts

4. Notice of Investigative Report = Part 2 of the Application

5. Consideration | Free Look, Grace Period & Reinstatement

6. Dividends are not guaranteed = Participating policies sold mutual insurers.

7. Notice of Replacement = NAIC/ Licensee & Applicant Signature Required

8. Collect Initial Premium* = Acceptance

9. Provide Insurability Receipt = Retroactive coverage from time of application.

10. This policy does not provide the 10 essential coverages to be deemed comprehensive

D.F.S. Health Buyers Guide Reference

https://myfloridacfo.com/Division/Consumers/understandingCoverage/Guides/documents/HealthGuide.pdf

Neil Schwabe | United Healthcare M.G.A. - L.U.C.T.F.

[ Define ]

Fixed

Indemnity

Limited Benefits

[ Explain ]

[ Explain ] Supplement to “Health Insurance”?

[ Identify ] (10) Minimum Essential Coverages

REQUIRED by the Affordable Care Act

[ Identify ] ACA = MAJOR Medical Coverage = Non-Grandfathered = Reimbursement type policy w/ NO Lifetime Limits.

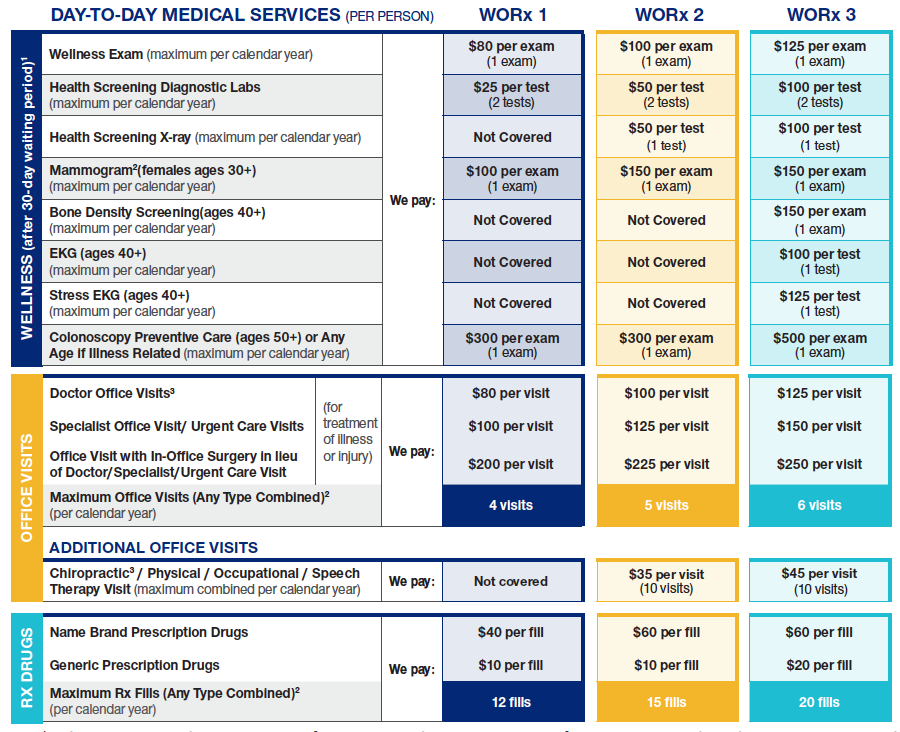

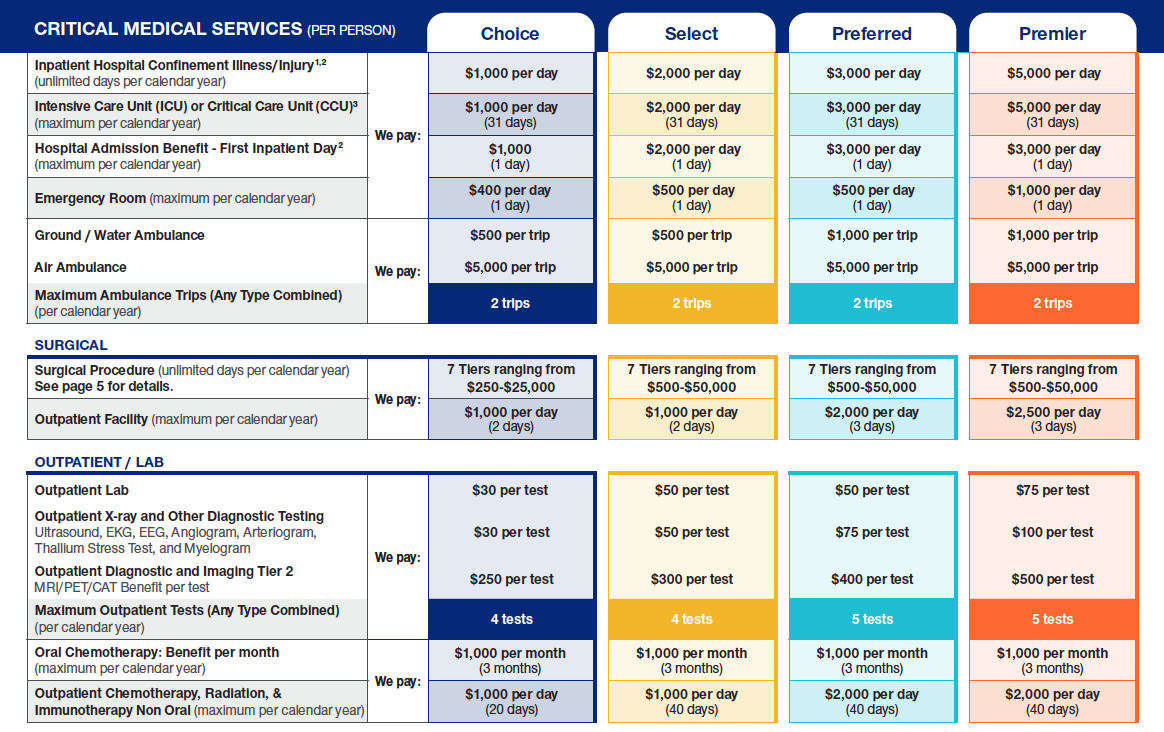

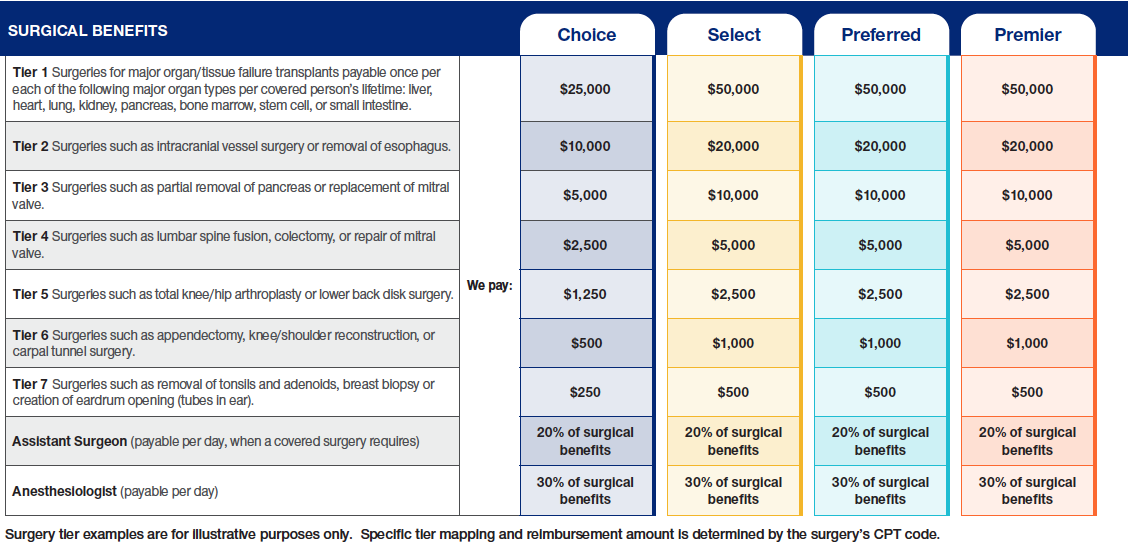

[ Define ] This product provides benefits in a STATED AMOUNT… Regardless of actual expenses incurred.

[ Identify ] Stated Amount = Valued Contract = Indemnity = LIMITS!

[ Identify ]

Office Visit = Physician (Non-Surgical)

Hospital Stays = Hospitalization = Room & Board

[ Define ] Deductible

[ Identify ] Why doesn’t this FIXED Indemnity product require policyholders to pay an initial deductible prior to receiving services? [ Identify ] Basic Medical Expense policies are called First Dollar Policies because they DO NOT require a deductible.

[ Explain ] CASH Benefits = The policy pays the policyowner.

[ Identify ] The brochure transitions into a list of common services accompanied by a LIMIT restricting usage to a specific number of visits.

[ Define ] In-Network [ Discuss ] Providers will not charge you more than the Network-NEGOTIATED RATE [ Identify ] Pre-Negotiated is a Preferred Provider Organization.

[ Identify ] Types of providers and the features which distinguish them.

[ Identify ] HMO, [ Contrast ] PPO

[ Identify ] POS as a less restrictive version

Private Fee For Service

[Identify] Creative need

*How content is used.

Pre-Licensing courses are designed to address industry basics. Typically, course content is delivered without a major brand backing. No laws against it. Just not much out of the box creativity.

Our goal is to prepare students for the state exam. We’ll be using all the conventional pre-licensing resources. United Healthcare branding would act as actual industry validation. The United Healthcare supporting materials would help us reinforce the 1st three steps in launching a New Insurance Career.

Pass pre-licensing,

Pass the State Licensing Exam and,

GET APPOINTED WITH

UNITED HEALTHCARE via Neil Schwabe

Average pre-licensing courses simply have students memorize vocabulary. If an instructor is involved, they’re often reciting the same generic stories from the text.

[Comparison]

The following identifies how my Authorized courses compliantly use #MyFloridaCFO .com content to teach students the *Florida Rules and Regulations portion of Pre-Licensing (24%).

The presentation logic and purpose remains the same for discussions capable of referencing United branded materials.

Currently, our courses open by identifying state regulators and their responsibilities. Rather than direct students to pages 402 through 442 in the state manual, we introduce students to The Florida CFO Jimmy Patronis.

www. My Florida CFO .com

Here, students become consumers. They learn who the CFO is and, where to verify the Authorization status of the agents they communicate with. As we guide students through the Department of Financial Services website, we highlight the 6 Divisions with an active role in the regulating the insurance marketplace.

All of which are pre-licensing topics.

Most Floridians aren’t aware of the fact Florida has an AMAZING Consumer Services Division. We teach Locals where to go when they need help enforcing their rights and where to find Insurance Buyers Guides.

[p. 4] HMO, PPO, POS

[p. 8] Required Benefits

Neil Schwabe - M.G.A. | LUCTF

Co-Host of #TheMiamiLocals

Showing students – consumer HOW to find reliable answers makes them feel like the consumer they are. [Compare] During our sections focused on *Types of Policies, United Healthcare materials will be reinforcing how insurance vocabulary & concepts look in real life.

All segments featuring United Healthcare materials will be Co-Hosted by Neil Schwabe, a seasoned United Appointed agent.

-

[Request] We’d like to identify / discuss the Appointment process using United Appointment paperwork.

Using United Healthcare materials in a DFS Authorized 2-40 Pre-Licensing Course conditions our recruits for the United appointment. Once licensing & appointments are in place, the materials used to identify key words and concepts are again used during United sales trainings…

Hosted by Neil Schwabe.

In Conclusion…

EVERYTHING United Healthcare discusses with consumers and potential recruits is already public content so, we shouldn’t experience any issues here.

[Request] Basic United Healthcare marketing materials to identify proper advertising language. [Explain] WHY words like *ONLY and *FREE are forbidden in insurance advertisements.

[Purpose] Discuss compliant advertisements.

Where I see a need for United’s blessings occurs during our discussion on the licensees’ responsibilities as a field underwriter. We simply want to add a sample United policy application into a role-playing scenario.

Nothing weird… Just Neil Schwabe demonstrating a proper presentation so we can label the components relevant to Pre-Licensing. This recruiting campaign begins with a LIVE INSTRUCTOR led course with On-Demand replays. No videos are available until after the course segment has been completed. Videos are simply the Authorized Pre-Licensing Discussions as it’s registered with the Florida DFS.

Jason L. Perez

DFS Authorized Insurance Edu Provider.

Hospital Benefit Paid Per Day

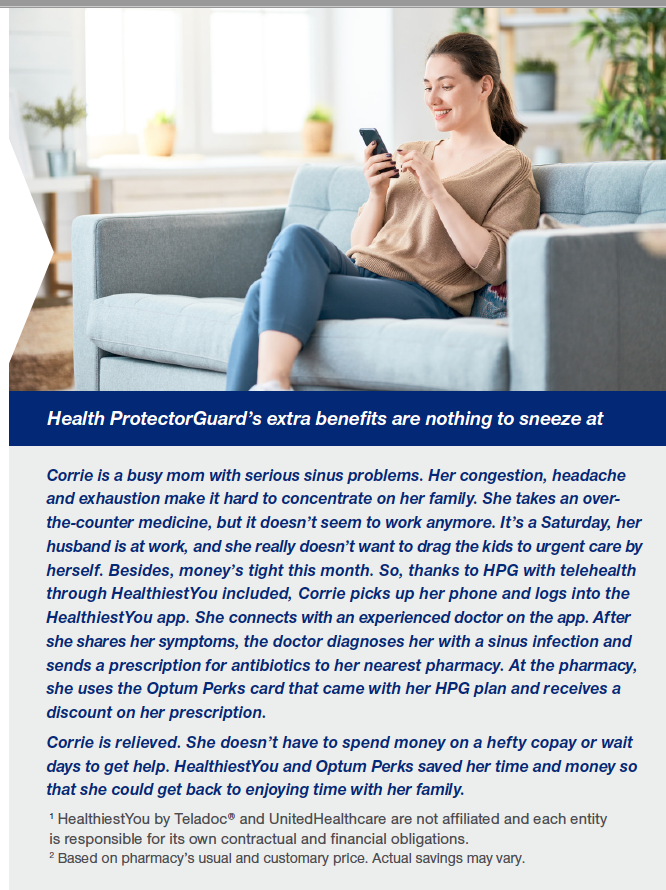

Health ProtectorGuard doesn’t stop with the fixed cash payments for covered services.

Every HPG plan includes telehealth benefits to help you access more affordable health care services.

Access the Optum Perks Rx discount card to help with prescription costs for more savings.

Health ProtectorGuard doesn’t stop with the fixed cash payments for covered services.

Every HPG plan includes telehealth benefits to help you access more affordable health care services.

Access the Optum Perks Rx discount card to help with prescription costs for more savings.

Health ProtectorGuard doesn’t stop with the fixed cash payments for covered services.

Every HPG plan includes telehealth benefits to help you access more affordable health care services.

Access the Optum Perks Rx discount card to help with prescription costs for more savings.

[Discuss] Fair Credit Reporting Act & The right to dispute inaccurate information.

Health ProtectorGuard doesn’t stop with the fixed cash payments for covered services.

Every HPG plan includes telehealth benefits to help you access more affordable health care services.

Access the Optum Perks Rx discount card to help with prescription costs for more savings.

[Identify] M.I.B. Not for profit organization – provides information for profit insurers.

[Define] Reinsurers

The Obamacare Overkill... 6 Essential Coverages that Could Save You Thousands

Why are Entrepreneurs fleeing Obamacare?

Six Essential Coverages Everyone Should Have

The Obamacare Overkill... 6 Essential Coverages that Could Save You Thousands

Why are Entrepreneurs fleeing Obamacare?

Dezerlands 007 Resturant Reviewed by @SspecialK & LokkoM3